Think about the concept of retirement for a minute. A person works their entire life, gains massive amounts of valuable experience, becomes extremely productive, and then checks out at the peak of their career. Odd is it not? But given expected life spans, and what it costs to save for the Golden Years, this is how it’s done. The problem today is, the Baby Boomer generation is such a big, productive part of the economy, that as these older workers retire, they leave a massive skills and productivity gap in their wake.

Research from RAND Corp. says Boomer retirements will even lower GDP expectations for years. Bloomberg’s Jeanna Smialek reports:

The retirement of baby-boomers in the decade between 2010 and 2020 will lower GDP growth per capita by 1.2 percentage point a year from what would have been the case if the nation’s demographics had held steady, according to a National Bureau of Economic Research study out this week. The bright side is that the dent is only half as deep between 2020 and 2030 as the pace of aging slows.

The study is based on a simple idea: population aging is already long underway and has been playing out with varying degrees of intensity across different regions of the country. By looking at variations in state population aging, authors Nicole Maestas at Harvard Medical School, and Kathleen Mullen and David Powell at policy research group RAND Corporation, are able to estimate how a graying workforce affects output, participation rates and productivity.

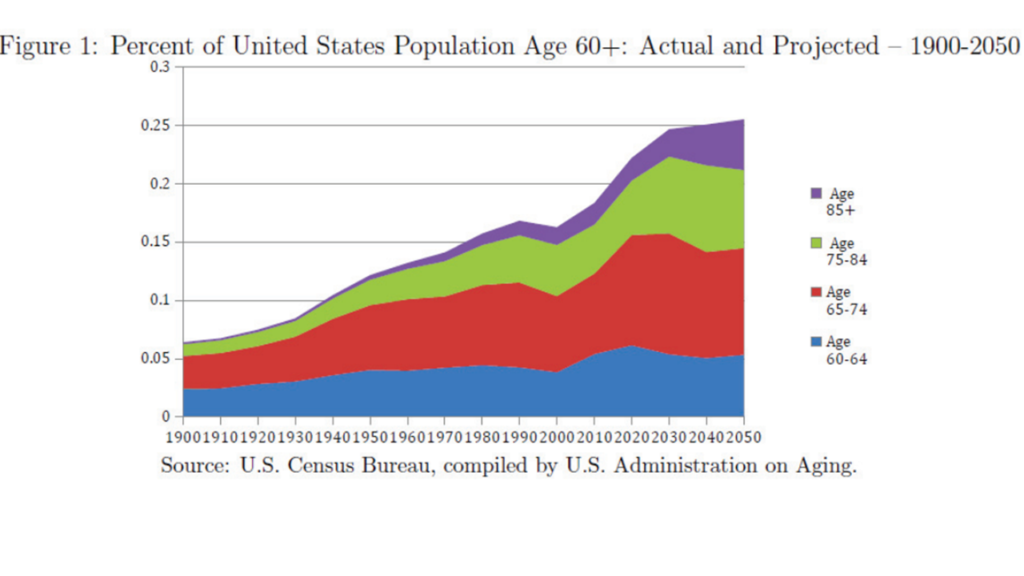

You can see in the figure from the report below that the proportion of America’s population aged over 60 has increased substantially since 1900, and is projected to increase much more by 2050. Barring some policy change or demographic explosion, America could be facing years of reduced productivity to come. Read the full report here.